Our Businesses

Businesses of the LIFULL Group

In order to realize our Corporate Philosophy, we offer our lifestyle-centered services focused around real estate in over 60 different countries and regions under our credo of "Atruism." As of the end of September 2023, the LIFULL Group is comprised of 38 companies (10 in Japan and 28 overseas) divided into three segments: HOME'S Services, Overseas and Other Businesses.

Revenue by Segment

FY 2023/9

Consolidated Revenue:

¥36.4Bil.

By Region

Revenue Breakdown

- 1 Calculated based on LIFULL CONNECT management accounting.

- 2 Regional breakdown was calculated based on client location.

Headcount

- 3 Regional breakdown based on location of entity to which employees belong.

Segment Overview

HOME'S Services

The HOME'S Services segment is focused around our flagship service, LIFULL HOME'S, one of the largest real estate and housing information websites in Japan. In this segment, we provide services to assist realtors and help each user easily find the right place to live according to their individual needs.

Through these services, our goal is to create a world where LIFULL HOME'S is an indispensable service.

Primary Services

- LIFULL HOME'S

- AD Master (Prev. Renters Net)

- NabiSTAR

- Kenbiya

- LIFULL Tech Vietnam、LIFULL Tech Malaysia (Offshore Development)

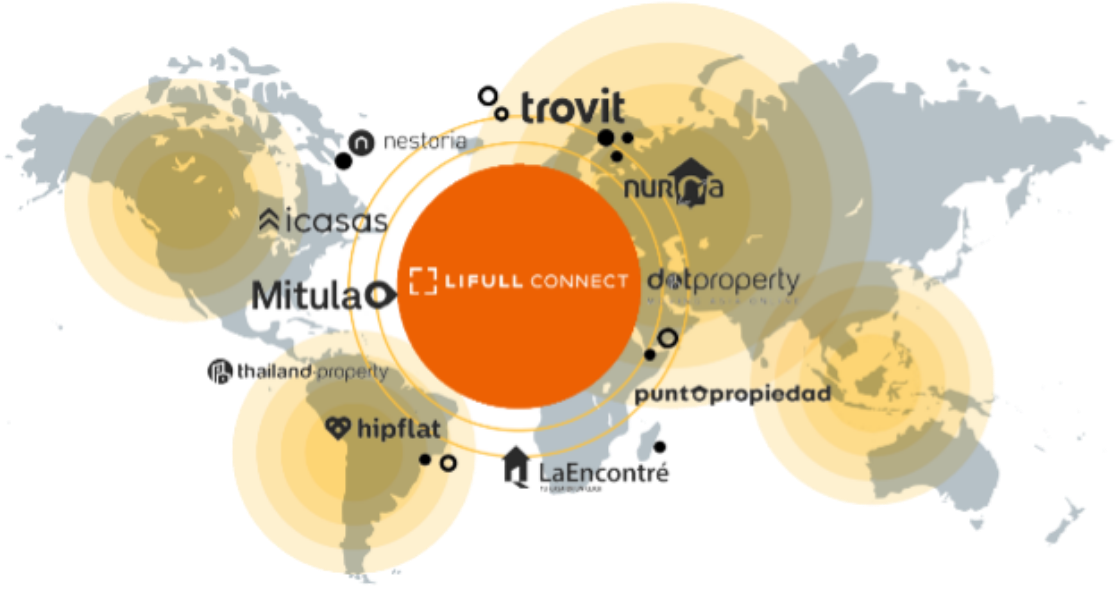

Overseas

The primary subsidiary of the Overseas segment, LIFULL CONNECT, offers services in over 60 countries around the world. In addition to our aggrigation sites Trovit, Mitula, Nestoria and Nuroa which offer information on real estate, jobs and used cars as well as, LIFULL CONNECT also operates a network of real estate portals across Latin America and Southeast Asia, such as RESEM, Dot Property and Lamudi. Finally, our tech-enabled real estate agency, FazWaz, provides real estate services directly to individual buyers and sellers. With our vast amounts of data and connections to users around the world, we are working to create a global real estate platform to allow people to invest more easily in international real estate regardless of language or nationality.

Primary Businesses

- Aggregation Sites (Trovit, Mitula, Nestoria, Nuroa)

- Real Estate Portals (PROPERATI, Lamudi, etc.)

- Tech-enabled Agency (FazWaz)

Other Businesses

In our Other Businesses, we are nuturing start-ups and investings in new businesses that go beyond real estate and online services to help people live more fulfilling lives. We also offer our employees as well as students and members of the broader community the opportunity to start their own businesses through our business proposition program, SWITCH. Through this program we are not only broadening our own business scope, but also training the next generation of leaders. In the future, we will continue to augment and expand the scope of the entire LIFULL Group through this segment.

Primary Businesses

- LIFULL Kaigo: LIFULL senior Co., Ltd.

- Regional Revitalization

- Other subsidiaries and start-ups of LIFULL

Review of Business Results

Business Results for FY 2023/9

Overview

The economy of Japan has begun to experience recovery through measures against the COVID-19 pandemic, which started to spread in 2020. However, increased inflation around the world and the weak yen have resulted in higher energy and material costs, which has driven up the cost of living. For these reasons, the future continues to remain partially uncertain.

In the construction and real estate industries, the primary industries of our clients, new housing starts have declined about to about 97% over the previous year. At the same time, the market has remained robust with growing volumes of resale property transactions and increasing property prices. Overseas, countries around the world are being affected by global inflation, monetary tightening and other issues affecting multiple countries which, in turn, have caused stagnation in the real estate and advertising markets.

In this environment, we have also been making proactive investments in the HOME'S Services, which includes our flagship real estate information service in Japan, and the Overseas segment for growth in the mid to long term. Although we are investing in the mid to long-term growth of our core services, we also exited from our vacation rental business and other ancillary businesses, stopped certain investments and have been focusing our management resources on the core businesses.

As a result, we ended the period with sales revenue of ¥36,405 million (+1.9% YoY), operating profit of ¥1,959 million (+17.2% YoY), profit for period before taxes of ¥1,634 million (+17.9% YoY), profit for the period of ¥1,055 million (-10.9% YoY) and profit for the period attributable to owners of the parent of ¥1,031 million (-12.6% YoY).

Segment Results for FY 2023/9

Inter-segment transactions have been eliminated from the figures for each business segment.

HOME'S Services

During the current fiscal year, we took steps to further improve the value we provide to our clients and users while also increasing our own competitiveness. We continued to make investments into developing our services and improve the value that we provide to both users and clients while also increasing our own competitiveness. In order to transform LIFULL HOME'S into a site where users can find exact home for their preferred lifestyle, we developed new features using AI technology and improved the quality of the user experience while also strengthening and increasing our client network. We also returned branding spending back to levels of three years ago. As a result of these initiatives, we

increased the profitability of LIFULL HOME'S while maintaining the total numbers of inquiries through the website.

Due to the above, segment revenue amounted to ¥23,165 million (-11.2% YoY). However, removing the results of LIFULL Marketing Partners (LMP), a subsidiary sold in the previous fiscal year, segment revenue would have grown 2.7% YoY. Segment profit amounted to ¥2,644 million (+657.0% YoY) primarily due to reduced advertising spending.

Overseas

During the current fiscal year in the Overseas segment, we have followed our growth strategy "Moving to Direct" (making investments to increase the value we provide to both users and clients through our services) and acquired two new companies in our key regions of Southeast Asia and Latin America. In Southeast Asia, we acquired FazWaz which offers tech-enabled real estate agent services. In Latin America, we acquired Lamudi Mexico which operates a leading real estate portal in Mexico. In particular, after acquiring FazWaz, we have increased the number of transactions that the tech-enabled real estate company completes and considerably grown the business scope of the Overseas segment.

At the same time, conflicts around the world as well as global monetary tightening etc. have caused stagnation in some of our main countries causing some of our clients to go bankrupt or lower their advertising spending. These issues caused revenue from premium advertisements on our aggregation websites to decline significantly.

As a result, sales revenue for the Overseas segment amounted to ¥8,668 million (+20.4% YoY.) However, if the effects of the sale of Kleding B.V., operator of the fashion aggregation site Fashiola, are excluded, segment revenue would have increased by 30.3% YoY. Segment profit amounted to ¥3 million for the current fiscal year (a decline of 99.4% YoY.)

Other Businesses

Although LIFULL senior, operator of LIFULL Kaigo, increased advertising spending for branding initiatives, the Real Estate Revitalization Fund, which invests in real estate repurposing projects that bring business into rural areas of Japan sold two hotel development projects during the second quarter and land for hotel development during the third quarter.

As a result, the sales revenue for the Other Businesses segment amounted to ¥4,926 million (+79.4% YoY)

and segment loss amounted to ¥204 million (an improvement of ¥456 million over the loss of ¥661 million in

the previous fiscal year.)

Additionally, we have resolved to transfer all shares of LIFULL SPACE, which operates the rental storage facilities LIFULL Trunkroom, in order to focus our resources on growing our other businesses.(Release from September 22, 2022)

Past Reviews of Business Results

Refer to the Financial Highlights for Details on Quarterly Earnings

Financial Highlights