Our Mid-Term Management Plan

Mid-Term Management Plan

Developing the Mid-Term Management Plan

The Mid-Term Management Plan of the LIFULL Group is designed both top down and bottom up in order to include the opinions of as many individuals, both management and employees, as possible.

First, the management of the LIFULL Group holds discussions about the direction that they want to take the Group and share the information within the Group. In the next step, all of the individual departments and subsidiaries create plans to reach the goals set by the management. Finally, after discussions, the Mid-Term Management Plan is finalized and submitted to the Board of Directors for approval.

By ensuring that multiple viewpoints are included throughout this process, employees work more passionately on their individual projects.

Mid-Term Management Plan (FY 2020/9 – FY 2025/9)

Key Topics of the Mid-Term Management Plan

Increasing Revenue and Profit for the LIFULL Groupby finding solutions to social issues through our existing businesses

We have to work outside of existing frameworks in order to solve social issues. By working together with our business partners, local governments, educational institutions and other related organizations, we are helping to find solutions to even more social issues.

In our Mid-Term Management Plan, we are actively investing in our businesses to main and strengthen a healthy financial foundation for stable returns while also enhancing shareholder value for the mid to long term. Our policy is to further improve returns to our shareholders by increasing revenue and profit margins.

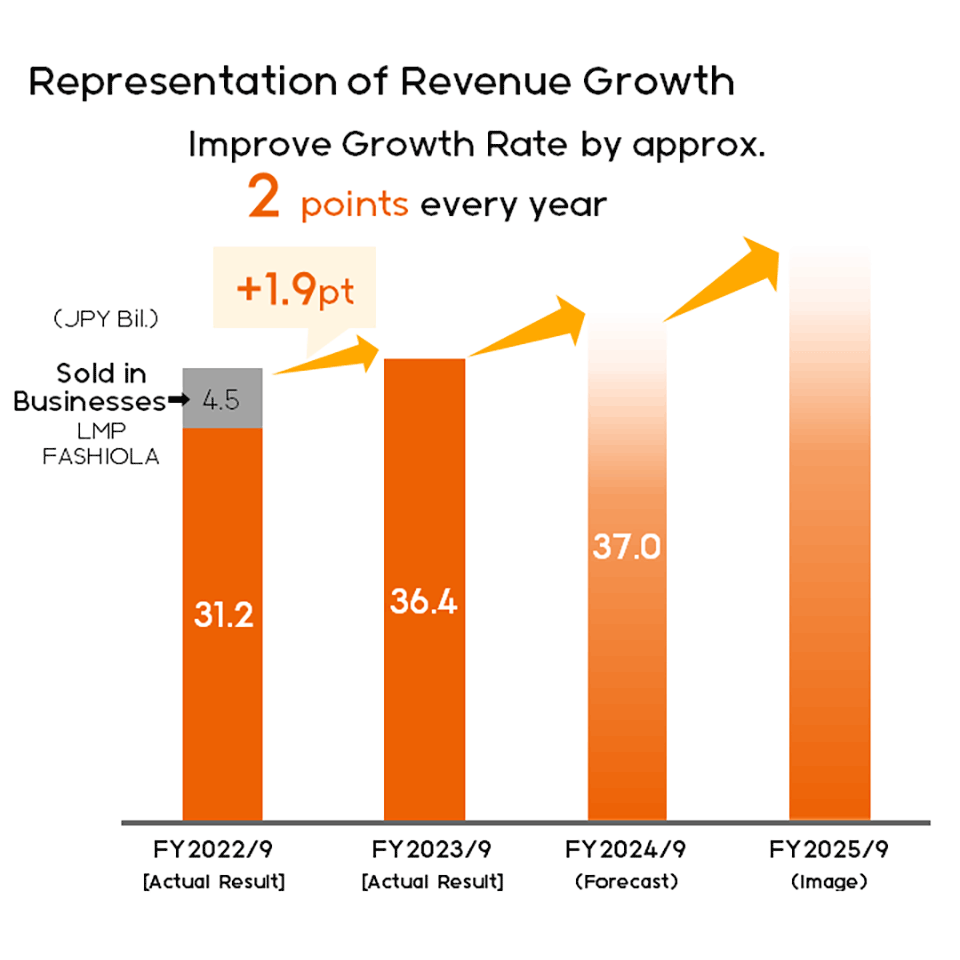

KPI and Future Projection

By the end of Sep. 2025

Revenue: Improve by 2pts each year

Operating Profit: ¥5.0 bil.

Changes to the Mid-Term Management Plan (Rolling)

- Original Concept:

Updating the Mid-Term Management Plan and results forecast on an annual basis while monitoring the effects of COVID-19 - Nov. 2021:

Focus on core businesses and revisions to investment plans due to downsizing portfolio

Changed KPI

Revenue: Compound Annual Growth Rate (CAGR) 15%

Operating Profit Margin: Approx. 20% - Nov. 2022:

Incorporated effects of sold businesses

Changed KPI

Revenue: Improve by 2 pts each year

Operating Profit: Reach ¥5.0 bil. (highest profit ever) by the end of September 2025

Focal Points

HOME'S Services: Evolving into a SUPER HYPER ASSISTANT

We are focusing our resources on further improving user and client satisfaction through our two main pillars: Omnichannel and Digital Transformation (DX). We cater to a wide variety of home-seekers looking for anything from rental apartments to buying or even building their own homes through our various channels (omnichannel) including via our websites, chat or offline over the phone or in person. We are also working toward the acceleration of the digitalization of processes related to moving and aiming to provide a completely personalized home-search process by augmenting the features we provide utilizing our data and cutting-edge technology such as AI or xR.

Overseas: MOVING TO DIRECT

We're working on further building up our network of real estate portals and providing richer listings and options to our users and clients in emerging real estate markets where major players do not yet exist, such as Latin America and Southeast Asia. We are maintaining flexibility over our costs in markets affected by COVID-19 in order to ensure overall growth in profitability.

At the same time, we are also working on building global real estate investment platform by leveraging the enormous amount of data we have with the latest technology and the traffic of the entire LIFULL CONNECT Group.

Other Areas

Through our Regional Revitalization business, we are focusing on working together with local governments to stimulate rural areas of Japan with a focus on abandoned homes. We're also working on expanding opportunities for new lifestyles for after retirement for the aging population of Japan.

Actions to Help Reach Our Mid-Term Targets

Buy-in Stock Option

In order to further increase revenue and profit as well as corporate value of LIFULL and the entire LIFULL Group over the mid- to long-term, we have issued share acquisition rights to our directors and employees for a fee in order to further increase motivation to achieve the performance targets set forth in our Mid-Term Management Plan. (Release from November 9, 2022)

| Eligible Parties | Requirements |

|---|---|

| Directors, Managing Directors and other CxO Positions | Consolidated Operating Profit: Over ¥5.0 bil. and Operating Profit for LIFULL Co., Ltd.: Over ¥3.0 bil. |

| Other Employees of LIFULL Co., Ltd. other than those listed above | Operating Profit for LIFULL Co., Ltd.: Over ¥3.0 bil. |