- TOP

- Sustainability

- Corporate Governance

Corporate Governance

- Basic Policy on Corporate Governance

- Corporate Governance System

- Management Structure

- Executive Remuneration

- Nomination and Remuneration Committee

- Internal Control

Basic Policy on Corporate Governance

Basic Policy

The primary goal of our business operations is to fulfill our social responsibilities to all of our stakeholders, including our direct customers, shareholders, employees, trading partners, bondholders and local communities. In order to achieve this goal, we will strengthen our management practices and construct a corporate governance system designed to accelerate decision-making and ensure proper execution of business while increasing efficiency and transparency.

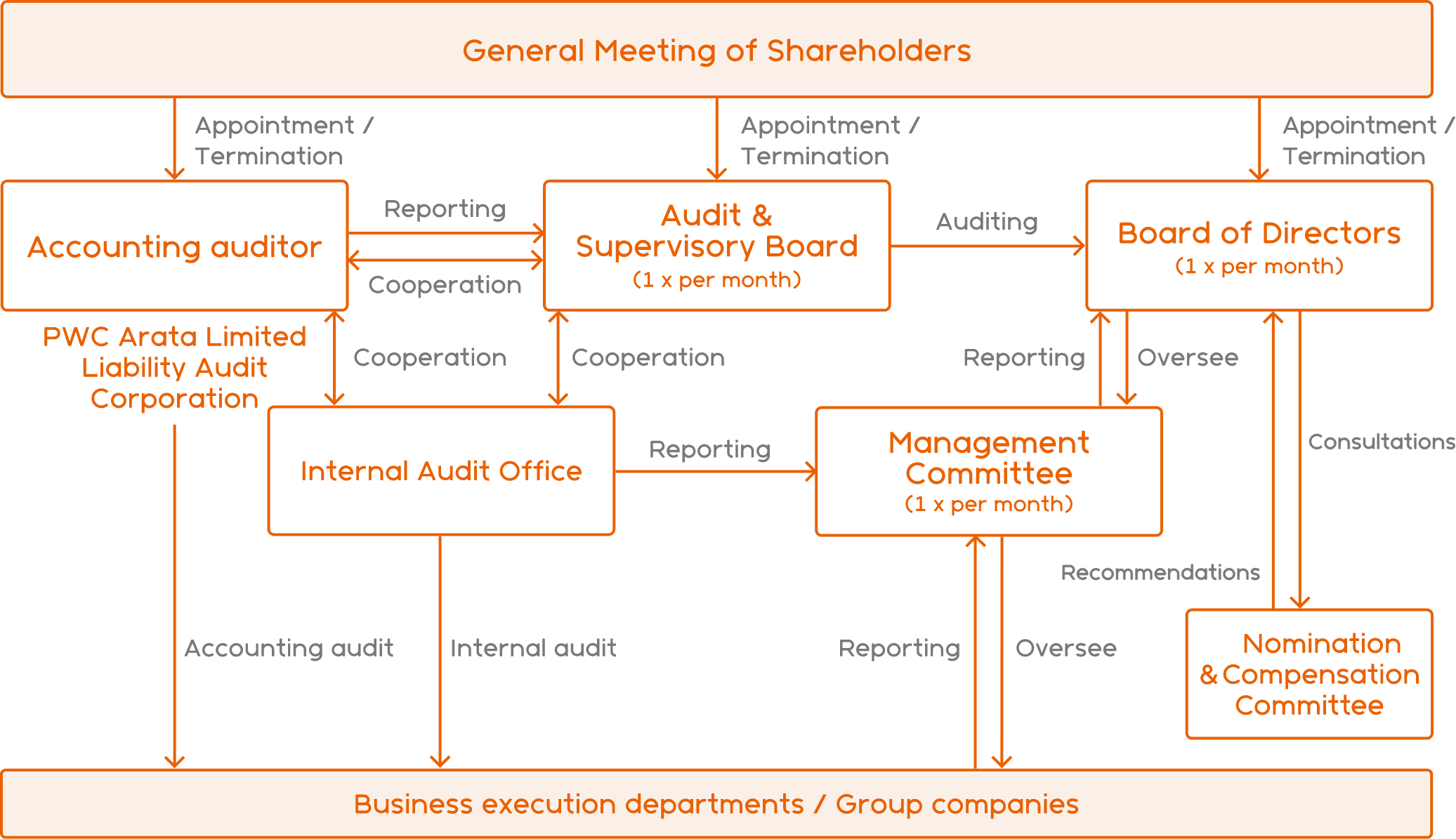

Corporate Governance System (As of December 22, 2023)

Overview of our Governance

The LIFULL Board of Directors has established a Managing Officer system to further stimulate discussions at its monthly meetings. The Board of Directors is comprised of 9 members including 4 outside directors who form the core of the management and aim to accelerate decision-making and improve the validity, efficiency and transparency of business initiatives.

In principle, the Board of Directors convenes once per month and, in addition to making decisions on basic policies and other important matters, supervises the execution of business by the managing officers in line with these decisions.

We have also adopted an auditor system. There are four auditors, with one full-time auditor and three external auditors. In general, all of the auditors attend the monthly meetings of the Board of Directors. The full-time auditor also attends important meetings such as management conferences, and supervises the overall execution of the directors' responsibilities.

In addition, a Management Committee consisting mainly of the full-time directors and managing officers convenes each week to make proposals to the Board of Directors on matters related to strategic decision making and deliberate decisions to be made by the Board of Directors in advance.

Meetings of the Audit & Supervisory Board are generally convened once per month wherein Audit & Supervisory Board members exchange opinions on issues discussed at the meeting of the Board of Directors and the status of company management, draw up auditing plans including auditing policies and determine important auditing-related matters.

Reasoning for this System

Internal regulations stipulate that the chairperson of the Board of Directors shall be the Representative Director. The Company has currently implemented this scheme to prioritize business execution, but it is the aim of the Company to separate decision-making and supervision from business execution in the future.

Under the current system, oversight of management is performed by strengthening the cooperation between Directors and Corporate Auditors and effectively utilizing the functions of Corporate Auditors in our decision-making processes.

Policies and Procedures for the Board of Directors to Appoint Executives and Nominate Candidates for Directors or Corporate Auditors

Directors, auditors, and other executive candidates are appointed based on the experience, expertise and consideration for a balanced skill matrix of officers deemed necessary by the Company. In situations where the Company requires appointments of independent directors, candidates must also meet the criteria for independence and possess the necessary attributes. The Company also takes diversity into account in its decisions. The appointment criteria also stipulate that candidates must have the appropriate personal qualities to serve as officers. The Audit & Supervisory Board evaluates and provides feedback on Director and Corporate Auditor candidates nominated by the Representative Director. The Representative Director selects candidates for Director and Corporate Auditor and receives feedback from the Audit & Supervisory Board based on their evaluation. After considering this feedback, the Representative Director nominates candidates appropriately who are approved for election at the General Shareholders' Meeting by the Board of Directors.

Criteria for Independence of Outside Directors

The Board of Directors of the Company recognizes outside directors and outside corporate auditors (*1) who are independent of the management of the Group, fair and objective as independent directors as defined by the Tokyo Stock Exchange.

We have established the following selection criteria for outside directors in order to enable the selection of highly independent outside directors. However, if the Board of Directors reasonably determines that a candidate is suitable for the post of outside director, the criteria set out in this policy shall not exclude the candidate from being selected. A candidate selected in this manner cannot be appointed as an independent director. Persons selected for a post as outside director should do their best to maintain their independence until stepping down.

- A person who executes business on behalf of the Company or its affiliated companies (*2)

- A person who has an important business relationship with the Company (*3) or who executes business on behalf of such a person*2

- A person who is a major shareholder (directly or indirectly holding 10% or more of the voting rights) of the Company or who executes business on behalf of such a person (*2)

- A person who executes business on behalf of a major investor (directly or indirectly holding 10% or more of the voting rights) of the Company or its affiliated companies (*2)

- A consultant, an accounting expert, or a legal expert who receives a considerable amount of cash or other assets (*4) other than remunerations as a director of the Company or its affiliated companies (when a party who receives such assets is an organization, such as a corporation or an association, this shall refer to a person who is associated with that organization)

- A person to whom any of (a) to (e) above have applied in the past three years

- A person who is a close relative of a person to whom any of (a) to (e) above apply (*5)

- *1 As we do not create distinctions on the independence of directors and corporate auditors, we collectively refer to them as "outside officers.

- *2 A person who executes business on behalf of the Company or its affiliated companies includes directors (other than outside directors), executives, and corporate officers and employees, etc.

- *3 A person who has an important business relationship” as defined in Article 2, Paragraph 3, Item 19 of the Ordinance for Enforcement of the Companies Act

- *4 A considerable amount of cash or other assets” is defined as cash or other assets of ¥10 million or more received in the previous fiscal year other than those received as remuneration as a corporate officer

- *5 A close relative” is defined as relatives and those sharing a means of livelihood

Conflicts of Interest

Process by which the Board of Directors Avoids and Manages Conflicts of Interest

The Board of Directors approves and reports any conflicts of interest appropriately according to legal standards.

Information Regarding Conflicts of Interest

- 1. Cross-Board Membership

Disclosed as appropriate in the Securities Report (Yukashoken Hokokusho) - 2. Cross-Shareholdings

The Company does have any strategically held shares.

The Company's holding policy for strategically held shares is limited to business alliances which reasonably contribute to the expansion and growth of the existing businesses and new business opportunities of LIFULL and the LIFULL Group. The Management or Board of Directors make judgements on the suitability of potential investments in accordance with internal standards. - 3. Existence of Controlling Shareholders

Disclosed as appropriate in news releases - 4. Related Party Disclosures

Disclosed as appropriate in the Securities Report (Yukashoken Hokokusho)

Oversight of Business by Directors who are not Managing Officers

No applicable items.

Evaluating the Performance of the Board of Directors

Since June 2016, the Board of Directors has undergone annual assessments and evaluations to determine its effectiveness. Each of the Directors and Corporate Auditors receives and completes a questionnaire, and the results of this questionnaire as well as areas for improvement are reported and discussed at a subsequent meeting.

The effectiveness of the Board of Directors is evaluated based on the following:

- a Number of members and composition of the Board of Directors

- Appropriateness of the standards for the Board of Directors

- Facilitation of meetings

- The mid-term strategy of the Board of Directors and discussion of executive candidates

For the latest analysis and evaluation of the effectiveness of the Board of Directors, a summary of the results has been published in the Corporate Governance Report (in Japanese.)

Executive Support

The Company has also established an independent internal audit department (consisting of four personnel) separate from the areas being audited.

- Create the annual schedule for the Board of Directors.

- Share the agenda items appropriately with outside directors in order to provide ample opportunity for discussion in meetings.

- Ensure appropriate time for reviewing materials to provide ample opportunity for discussion in meetings.

- Share agenda item materials 4 business days prior to meetings for directors to review to provide ample opportunity for discussion in meetings.

Provide the following support to executives to ensure ample opportunity for discussion in meetings:

The full-time corporate auditors also attend Management Meetings not only for the purpose of confirming the discussions and decisions made within meetings, but also to provide their own opinions on agenda items

Executive Training

The executives all possess abundant experience as well as professional knowledge and understanding in their respective areas. However, in order to maximize the benefits of their knowledge and experience in forming and executing the Company's business strategy, we provide them with the following training:

- Explanation of the Company and its businesses for newly appointed executives held by a member of Corporate Planning on dates separate from Board of Directors meetings

- Opportunities to explain the Mid-Term Management Plan and business strategies of the Company for outside directors on dates separate from Board of Directors Meetings

- Reports to outside directors on overviews and strategies of subsidiaries held by executives of subsidiaries of the Company on dates separate from Board of Directors Meetings

Internal Audit Office

The Company has also established an independent internal auditing office (4 members) which reports directly to the representative director. The Internal Audit Office ascertains the risks related to the Company itself as well as its subsidiaries and carries out internal audits based on the internal audit plan formulated based on importance and urgency.

Additionally, the office regularly reports the results of its audits to the Representative Director and Full-Time Internal Auditor who, then, reports these results to the Audit & Supervisory Board. The Internal Audit Office also ensures coordination with the Board of Directors by directly reporting its audit plans and results.

If the Audit and Supervisory Board members should require support personnel for logical reasons, the Company will assign the appropriate personnel. These personnel will not receive instructions or orders regarding auditing work from anyone other than Audit and Supervisory Board members. In addition, the appointment, removal, evaluation and relocation of these personnel shall be reported in advance to the Full-Time Internal Auditor and receive the approval of the Audit and Supervisory Board.

Management Structure (As of Dec. 22, 2023)

Directors

| Representative Director, Chairperson | INOUE Takashi |

|---|---|

| Representative Director, President, Managing Officer | ITO Yuji |

| Director | SHISHIDO Kiyoshi |

| Director | SHIMIZU Tetsuro |

| Director, Managing Officer | YAMADA Takashi |

| Director | KOBAYASHI Masatada [Outside Director] |

| Director | NAKAO Ryuichiro [Outside Director, Independent Officer] |

| Director | OKUBO Kazutaka [Outside Director, Independent Officer] |

| Director | KIMURA Naonori [Outside Director, Independent Officer] |

Audit & Supervisory Board Members

| Full-Time Audit & Supervisory Board Member | OHSUMI Shoko |

|---|---|

| Audit & Supervisory Board Member | NAKMORI Makiko [Outside Officer, Independent Officer] |

| Audit & Supervisory Board Member | MATSUSHIMA Kie [Outside Officer] |

| Audit & Supervisory Board Member | NISHIGAKI Atsushi [Outside Officer, Independent Officer] |

Skill Matrix for the Board of Directors and Audit & Supervisory Board

When naming Directors, the Company takes a holistic approach considering the balance of the overall skill matric with emphasis on the necessary experience and professional knowledge of each candidate, and independent officers must be meet the independency criteria. Finally, the Company also pays consideration to the diversity of the board as well as ensuring that each Director possesses the personal qualities to serve as officers.

In addition, based on our Mid-Term Management Plan, we have selected 10 skill areas. We disclose the following skill matrix with the intention of achieving a balanced and diverse composition, both overall and in terms of scale, for the Board of Directors and Audit & Supervisory Board.

(Note: The table below does not represent all the knowledge and experience possessed by each director and auditor.)

| Position in the Company (scheduled) | Name | Skills and experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Practice of corporate philosophy* | Management experience | Global | Sustainability | Real estate | Financial sector | Technology | Legal affairs/Risk management | Accounting/Finance | M&A | ||

| Representative Director,Chairperson | INOUE Takashi | ||||||||||

| Representative Director,President,Managing Officer | ITO Yuji | ||||||||||

| Director | SHISHIDO Kiyoshi | ||||||||||

| Director | SHIMIZU Tetsuro | ||||||||||

| Director,Managing Officer | YAMADA Takashi | ||||||||||

| Outside Director | KOBAYASHI Masatada | ||||||||||

| Outside Director | NAKAO Ryuichiro | ||||||||||

| Outside Director | OKUBO Kazutaka | ||||||||||

| Outside Director | KIMURA Naonori | ||||||||||

| Audit & Supervisory Board Member(Full-time) | OHSUMI Shoko | ||||||||||

| Outside Audit & Supervisory Board Member | NAKAMORI Makiko | ||||||||||

| Outside Audit & Supervisory Board Member | MATSUSHIMA Kie | ||||||||||

| Outside Audit & Supervisory Board Member | NISHIGAKI Atsushi | ||||||||||

*Corporate Philosophy: Credo: Altruism. Corporate Philosophy: Create a society where everyone can attain "comfort" and "happiness" through continuous social innovations

Reason for Nominating Directors and Audit & Supervisory Board Members

| Title | Name | Reason for Nominating Directors and Audit & Supervisory Board Members |

|---|---|---|

| Representative Director, Chairperson |

INOUE Takashi | INOUE Takashi is the founder of the Company and has served as CEO since founding the Company. He plays an important role in the growth of the Group by demonstrating strong leadership in determining and implementing management policies and business strategies with his extensive experience and knowledge of the real estate industry and internet-based services. |

| Representative Director, President, Managing Officer |

ITO Yuji | ITO Yuji has been involved in various markets, such as those of the Rental and Sale divisions, since he joined the Company in April 2006. Currently, he oversees the LIFULL HOME'S Business Department, the core business of the Company, and we judge that we can expect him to continue contributing to sustainable improvement in the corporate value of the Company in the future. |

| Director | SHISHIDO Kiyoshi | SHISHIDO Kiyoshi has held positions as an executive director and representative director of the Mitsubishi Corporation and its affiliated companies, has abundant experience as a corporate manager and is familiar with global business. He has also served as an Outside Audit & Supervisory Board Member of the Company (full-time) since June 2016 and is familiar with the Company’s businesses. |

| Director | SHIMIZU Tetsuro | SHIMIZU Tetsuro has experience working in the financial industry for many years, serving in a succession of posts as director in the same industry. |

| Director, Managing Officer |

YAMADA Takashi | YAMADA Takashi has been involved in the development of the Company’s in-house services as a system engineer since he joined the Company in March 2000. Currently, he oversees the AI Strategy Office and Product Planning Division of the LIFULL HOME'S Business Department, two major divisions of the Company. |

| Outside Director | KOBAYASHI Masatada | KOBAYASHI Masatada has worked at Rakuten Group, Inc. for many years since its foundation, serving in a succession of posts such as executive and director at the firm and its affiliates. |

| Outside Director | NAKAO Ryuichiro | NAKAO Ryuichiro worked at Recruit Holdings Co., Ltd. and its affiliates serving in a succession of posts such as executive and representative director, so he has expertise and experience in a wide variety of areas including business development, marketing, organizational invigoration and KPI management, in addition to being familiar with the housing and technology sectors. |

| Outside Director | OKUBO Kazutaka | OKUBO Kazutaka is not only familiar with governance and finance with his auditing experience as a certified public accountant at a major auditing firm, but also has abundant expertise and experience in the fields of compliance and CSR, having served in succession as an expert committee member at various government offices and as secretary of business circles. |

| Outside Director | KIMURA Naonori | KIMURA Naonori has been involved in the fields of management reform and business strategies for many years, serving in a succession of posts as an executive for domestic and overseas businesses. Therefore, we believe he has extensive knowledge and experience in overall corporate management. |

| Audit & Supervisory Board Member(Full-time) | OHSUMI Shoko | Since joining the Company in September 2008, OHSUMI Shoko has served as a person in charge of the Financial Department, and has supervised the Internal Audit Office and Internal Control Department. She, therefore, has extensive knowledge related to finance, accounting, and governance. |

| Outside Audit & Supervisory Board Member | NAKAMORI Makiko | Although NAKAMORI Makiko has not been involved with corporate management other than as an outside officer, she has considerable knowledge on financial affairs and accounting as a certified public accountant. |

| Outside Audit & Supervisory Board Member | MATSUSHIMA Kie | Although MATSUSHIMA Kie has not been involved with corporate management other than as an outside officer, she has considerable experience and broad insight as an attorney-at-law. |

| Outside Audit & Supervisory Board Member | NISHIGAKI Atsushi | NISHIGAKI Atsushi has many years of experience working in the financial industry, serving in a succession of posts as executive and director at construction consulting companies. |

Diversity of the Board of Directors

We have set the percentage of female members of the Board of Directors as a KPI for our Focal Point for Sustainability, Diversity & Inclusion.

Sustainability Issues and Goals

Number of the Company’s shares held by Directors and Audit & Supervisory Board Members and Attendance at Meetings

| Title | Name | Number of the Company’s shares | Attendance | |

|---|---|---|---|---|

| FY2023/9 | FY2022/9 | |||

| Representative Director, Chairperson |

INOUE Takashi | 42,476,700 | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Representative Director, President, Managing Officer |

ITO Yuji | 27,100 | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Director | SHISHIDO Kiyoshi (Full-time Outside Audit & Supervisory Board Member until December 21,2023) |

17,500 | Board of Directors: 19/19 Audit & Supervisory Board Meetings: 17/17 |

Board of Directors: 18/18 Audit & Supervisory Board Meetings: 17/17 |

| Director | SHIMIZU Tetsuro (Assumed position as Director on November 14, 2023) |

14,200 | Board of Directors: 15/15 (Assumed position as Outside Director on December 22, 2022) |

― |

| Director, Managing Officer |

YAMADA Takashi | 167,400 | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Outside Director | TAKAHASHI Masato (Stepped down on December 22, 2022) |

― | ― | Board of Directors: 18/18 |

| Outside Director | KOBAYASHI Masatada | ― | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Outside Director | NAKAO Ryuichiro | ― | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Outside Director | OKUBO Kazutaka | 12,900 | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Outside Director | KIMURA Naonori | ― | Board of Directors: 19/19 |

Board of Directors: 18/18 |

| Audit & Supervisory Board Member(Full-time) | OHSUMI Shoko (Assumed position as Full-time Audit & Supervisory Board Member on December 21,2023) |

― | ― | ― |

| Outside Audit & Supervisory Board Member | HANAI Takeshi (Stepped down on December 22, 2022) |

― | ― | Board of Directors: 18/18 Audit & Supervisory Board Meetings: 17/17 |

| Outside Audit & Supervisory Board Member | NAKAMORI Makiko | ― | Board of Directors: 19/19 Audit & Supervisory Board Meetings: 17/17 |

Board of Directors: 18/18 Audit & Supervisory Board Meetings: 17/17 |

| Outside Audit & Supervisory Board Member | MATSUSHIMA Kie | ― | Board of Directors: 19/19 Audit & Supervisory Board Meetings: 17/17 |

Board of Directors: 18/18 Audit & Supervisory Board Meetings: 17/17 |

| Outside Audit & Supervisory Board Member | NISHIGAKI Atsushi (Assumed position on December 22, 2022) |

― | Board of Directors: 15/15 Audit & Supervisory Board Meetings: 13/13 (Assumed position on December 22, 2022) |

― |

*The number of the Company's shares held is as of March 31, 2024.

*Shares held by Representative Director, Chairperson, INOUE Takashi, are listed according to the actual number of shares as reported on the most recent Change Report submitted on March 15, 2023.

Executive Remuneration

Determination Process for Remuneration of Directors and Auditors

Policies for determining remuneration for directors and corporate auditors are described in the Corporate Governance and Securities Reports.

As directors are responsible for increasing value provided by the Company, the basic remuneration policy for directors is to secure and maintain an appropriate level for the execution of duties compared to the wage level of employees. Remuneration for full-time directors is based on sharing interests such as profits and risks due to changes in the Company's business performance and stock prices with shareholders with consideration to mid- to long-term contributions to business performance and improvement of corporate value. Remuneration for other officers consists solely of basic remuneration for their duties.

Remuneration for directors is determined by their LIFULL Group Vision Achievement Score (LVAS), a proprietary evaluation system that incorporates evaluation criteria, including 1) altruistic contributions, referring to contributions to society; 2) degree of growth and innovation; 3) contributions to the Group; and 4) embodiment of the organization’s vision. The amount calculated based on each officer's LVAS is paid as monthly remuneration over the following period.

Furthermore, remuneration amounts for each director and Auditory & Supervisory Board member are determined by the Board of Directors with approval from the Audit & Supervisory Board within the limits determined at the General Meeting of Shareholders with consideration given to Company performance, management duties, economic conditions and other factors.

Total Executive Remuneration

(For FY 2023/9)

| Position Executives | Receiving Payment | Total Remuneration(JPY mil.) |

|---|---|---|

| Directors (Outside Officers) | 8 (5) | 138 (29) |

| Auditors (Outside Officers) | 5 (5) | 42 (42) |

| Total (Outside Officers) | 12 (9) | 180 (71) |

Budget for Director Remuneration: ¥240 Million / Year

Budget for Auditor Remuneration: ¥50 Million / Year

*At the end of the current fiscal year, there are currently 8 Directors (including 5 Outside Directors) and the number of auditors is 4 (all of whom are outside auditors). The above table does not include one outside director who serves without remuneration. The discrepancy with the number of auditors in the table is due to the inclusion of one auditor (including one outside auditor) who retired at the conclusion of the 28th Ordinary General Meeting of Shareholders held on December 22, 2022.

Nomination and Remuneration Committee

Overview and Goals

The Nomination and Remuneration Committee has been established as an advisory body to the Board of Directors and follows the Nomination and Compensation Committee Regulations determined by the Board of Directors. The Board of Directors is responsible for consulting with the Nomination and Compensation Committee on matters such as the appointment, reappointment and succession plans for the Representative Director and other Directors, as well as the policy and content of director remuneration

This committee meets in March and September for matters related to nomination proposals and in January for matters related to remuneration proposals. The committee also meets on an ad hoc basis for urgent matters.

Composition

In addition to have an Independent Outside Director serve as the chairperson, over half of the members of the committee itself are also Independent Directors (2 Independent Outside Directors and Independent Outside Auditor (Full-time)) to ensure the independence of the committee.

Internal Control

Financial Reporting

In order to ensure the reliability of financial reporting, the Company has formulated the "Basic Policy for Constructing an Internal Control System" and established the basic policies for internal controls related to financial reporting. Based on this, the Company has developed related regulations such as the "Implementation Standards for Auditing of Internal Control Systems" and conducts evaluations by the internal control evaluation officer. Under the responsibility of management (the President and Representative Director), the Company produces an "Internal Control Report" as mandated by the Financial Instruments and Exchange Act. If there are areas for improvement in internal controls related to financial reporting, the internal control evaluation officer proposes improvement measures to management and addresses them accordingly.

Structure and Status of Internal and Accounting Audits

The auditors receive regular reports on the summary and results of financial audits from the accounting auditor. They, then, exchange information and opinions to improve the internal structure. Additionally, the internal audit department conducts internal audits based on the internal audit plan, regularly reports the results to the Representative Director and the Audit & Supervisory Board who, then, exchange opinions to enhance the overall auditing system.

Risk Management

Risk Management Systems

We have established a Risk Management Committee chaired by the Representative Director and a risk management system has been established wherein all risks that could have a significant impact on the Group are centrally managed. In order to ensure that we maintain a sound financial position and steadily achieve higher earnings by streamlining our operations, we have also established a department specialized in the maintenance of internal control systems and a system to check and improve the maintenance of internal regulations and the status of operations.

Business Continuity Plan (BCP)

We have formulated a Business Continuity Plan (BCP), which defines the procedures, personnel in charge, scope of work and other issues in advance to minimize damage in the event of a disaster or other emergency and ensure the continuation and early recovery of our core businesses. In addition, we conduct periodic drills to ensure the proper execution of our BCP in the event of an emergency and review the flow of the BCP including changes in procedures and personnel, etc. The Internal Audit Office also conducts BCP audits when necessary.

Information Security

Basic Information Security Policy

▼Basic Principles for Information Security

As an information service provider, the Group aims to safely maintain and utilize internal information as well as information entrusted to us by our customers. For this purpose, we have established a policy regarding information security for the security of our clients. Based on this policy, we have established a number of regulations to ensure information security and have educated our employees to maximize the appropriate management of all information.

- To ensure that information is used according to the purpose for which it was collected, we only allow employees to access the data necessary for their positions and work to ensure that the data we store is correct and complete.

- Our policies and internal regulations comply with all relevant laws and regulations and regularly train and test our employees on information security.

- In the event of a serious issues with information security, we will promptly investigate the causes and implement countermeasures.

- We also require Group employees to submit written oaths to adhere to the rules for the handling of information.

▼Privacy Policy

The LIFULL Group recognizes the importance of personal information and complies with the guidelines set forth in the Personal Information Protection Law to protect this information.

LIFULL Privacy Policy

Privacy Policy for Recruitment Activities

Privacy Policy for Employment Placement Services

Privacy Policy Regarding Personal Information of Shareholders and Investors

Acquisition and Use of Behavioral History Information

Behavioral Targeting Advertising

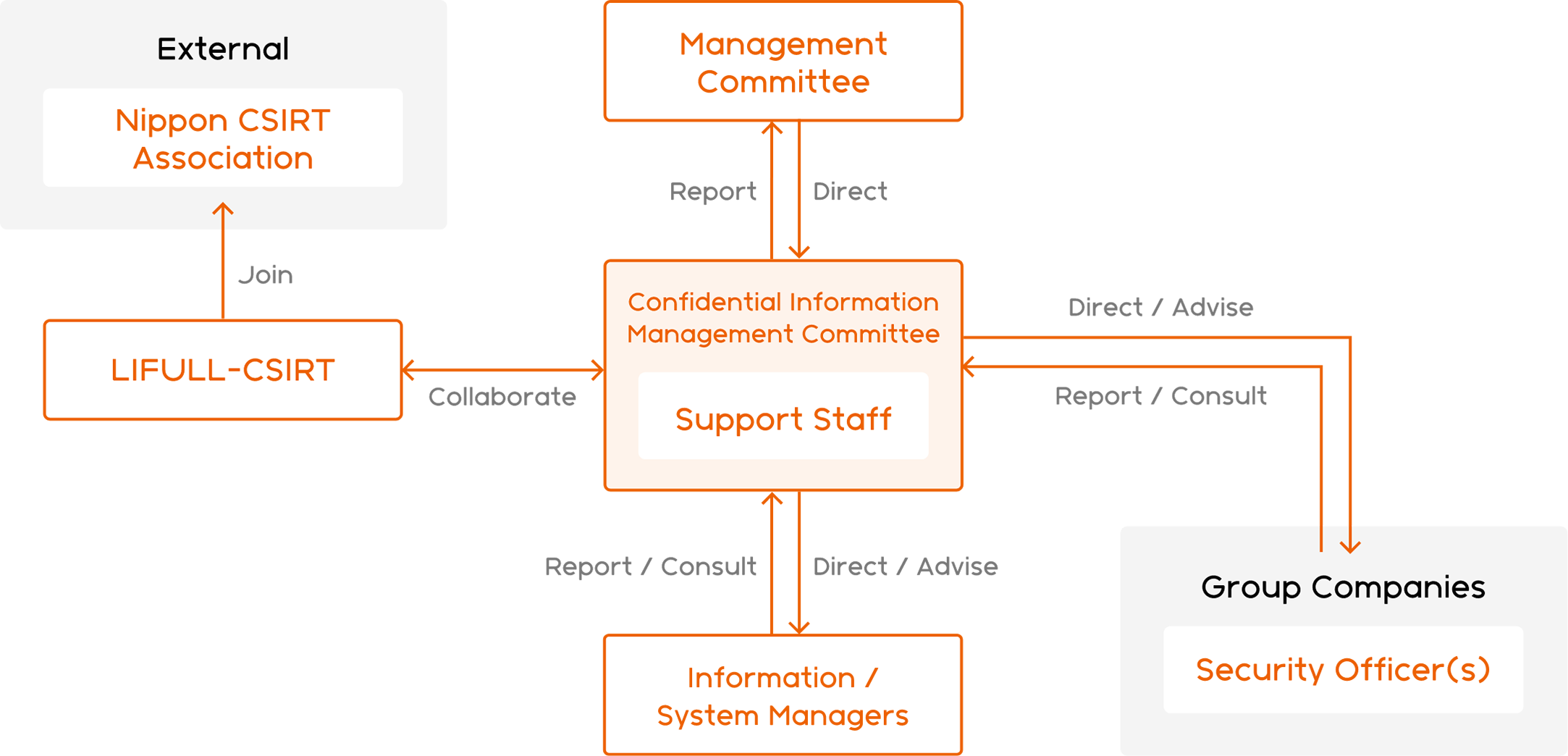

Promotion of Information Security

▼Security Efforts

We have established a committee devoted to the management of confidential information to protect and improve information management within the Group. This committee is charged with the regular review and approval of information security as well as internal information sharing, warnings and instructions regarding information security to team leaders.

The leaders of each individual department are also responsible for the management of information systems within their department. We also monitor whether the structure and operation of each ISMS is functioning effectively and continue to maintain and improve information security.

Ensuring Information Security

▼Recognition of ISMS (Information Security Management System)

After review by a third-party organization, LIFULL and its subsidiaries have received accreditation for the international information security standard ISO/IEC 27001 and Japanese standard JIS Q 27001 since 2006. All domestic subsidiaries have adopted the LIFULL information security policies and have implemented the same management systems for information security.

▼Actions on Computer Security Incidents and External Data Sharing

The LIFULL Group has established a computer security incident response team (CSIRT) and is registered as a member of the Nippon CSIRT Association. We will continue to improve the Group's cyber security to prevent the occurrence of security incidents.

In the future, we will continue to collaborate not only within the Group but also with other companies to strengthen security measures. When a security incident occurs, we will take measures to minimize and converge the damage.

*1: CSIRT (Computer Security Incident Response Team) refers to a team that responds to computer security incidents. We regularly collect and analyze incident-related data, information on vulnerabilities and information regarding previous attacks to formulate response policies and other procedures.

▼Security Measures During Service Development

Actions for the Provision of Secure Services

We have established a department dedicated to reviewing the security of our services. Developers must submit applications to this department when setting the requirements for a new service.

For services which handle personal information, we limit security issues by requiring security reviews when defining the requirements for a new service. We also ensure the security of our services by conducting vulnerability diagnoses before release.

▼Education on Information Security

We implement regular security tests to educate and test employees on their knowledge of the data necessary for their positions and understanding of rules throughout the entire LIFULL Group. In preparation for cyber attacks, we also regularly conduct training and confirm reporting flows for incidents to ensure the vigilance and awareness and prompt responses of our employees. Our engineers also attend security training to ensure that the LIFULL Group is providing safe and secure services to our customers.